Chairman's Message

Mansour Hamad Almubarak

Board Chairman

In the Name of Allah, the Most Mereiful, the Most Compassionate

Praise be to Allah, the Lord of All Worlds and prayers and peace be upon the Prophet (pbuh) and his family, companions and followers.

Our valued shareholders, Allah's peace, mercy and blessings be upon you

It gives me pleasure to welcome you at this General Assembly Meeting and to present to you the annual report of A'ayan Leasing and Investment Company. Fatwa and Sharia Supervisory Board's Report, Corporate Governance Report, the Audit Committee's Report, the Auditors ' Report and the financial statements for the financial year ended 31 December 2022.

The past year saw various repercussions that have had a profound impact on the local and global economy. After a positive start of market indices in the first half, they declined rapidly in the second half of 2022. This decline came rapidly due to a set of factors, most notably the global supply chain crisis, which cast shadow on inflation rates, which have reached exceptional levels in many countries. This pushed central banks to repeatedly raise interest rates to record levels in order to curb inflation, which would plunge the economy into a long recession tunnel. The Russian-Ukrainian war also led to complicating the status quo and affecting the economies of European countries in particular and all world countries In general.

At the company level, it focused during the past year on achieving its new strategy, which is based on creating an appropriate balance in the company's assets by seizing the appropriate investment opportunities and choosing the appropriate financial structure in order to maximize shareholders' equity and enhance the company's financial position. The company has focused on the growth of all its main operating sectors during the year, where the operating leasing sector grew up during the past year, driven by the high demand for new and used cars, with the company 's executive body having developed a targeted plan aiming at developing this activity in a thoughtful manner that matches the company's resources and customer demand. With respect to the direct investment, A`ayan

Company aimed to invest in stocks with operating performance and continuous distributions in order to build a balanced portfolio that could serve as a basis for future expansions. In the real estate sector, the company has worked to reshape the real estate portfolio by selling a group of low-yield properties and buying new properties with a view to earing better returns in light of considered risks commensurate with the company 's assets.

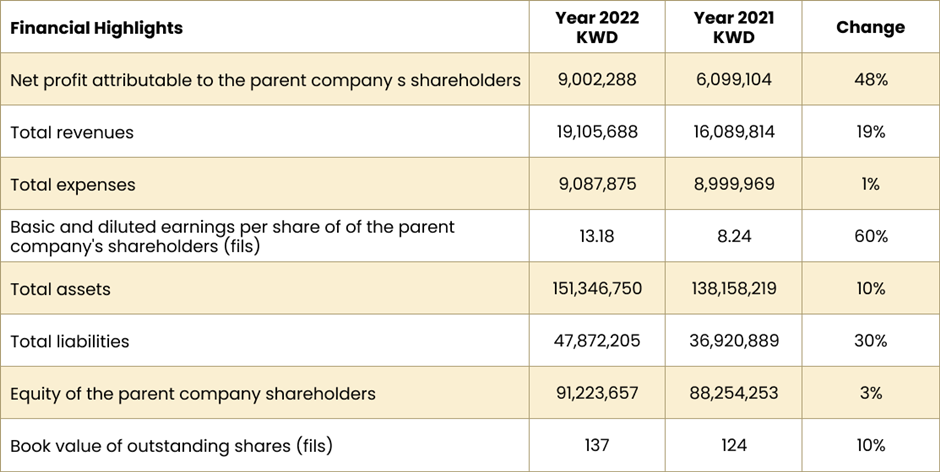

Thanks to God, and then the concerted efforts of the company's executive body, the company's profits jumped during 2022 to reach a net profit of approximately nine million Kuwaiti dinars, accompanied by a positive increase ın most of the company's financial indicators.

The following is a summary of the Group's key financial Highlights for year 2022 as compared to 2021

regulatory authorities.

We continue to closely follow up on the implementation oft the company’s strategy aiming at building a balanced financial structure that will redistribute company’s assets so as to enable all its sectors to contribute to fulfilling the targeted revenues, and achieving growth in shareholders’ equity as the the company works to target operational opportunities n various sectors, improve the, performance of its current assets and seek to participate in government tenders.

In this regard, I can only thank my brothers from members of the Board of Directors and the company's work team, who contributed to achieving exceptional results during the past year and bringing the company back to a solid financial position that allows it to share cash dividends with shareholders n light of the

growth of its various sectors and assets.